Present value of future cash flows calculator excel

An annuity is a sum of money paid periodically at regular intervals. Common equity preferred stock debt.

Formula For Calculating Net Present Value Npv In Excel

All in One Financial Analyst Bundle- 250 Courses 40 Projects 250 Online Courses.

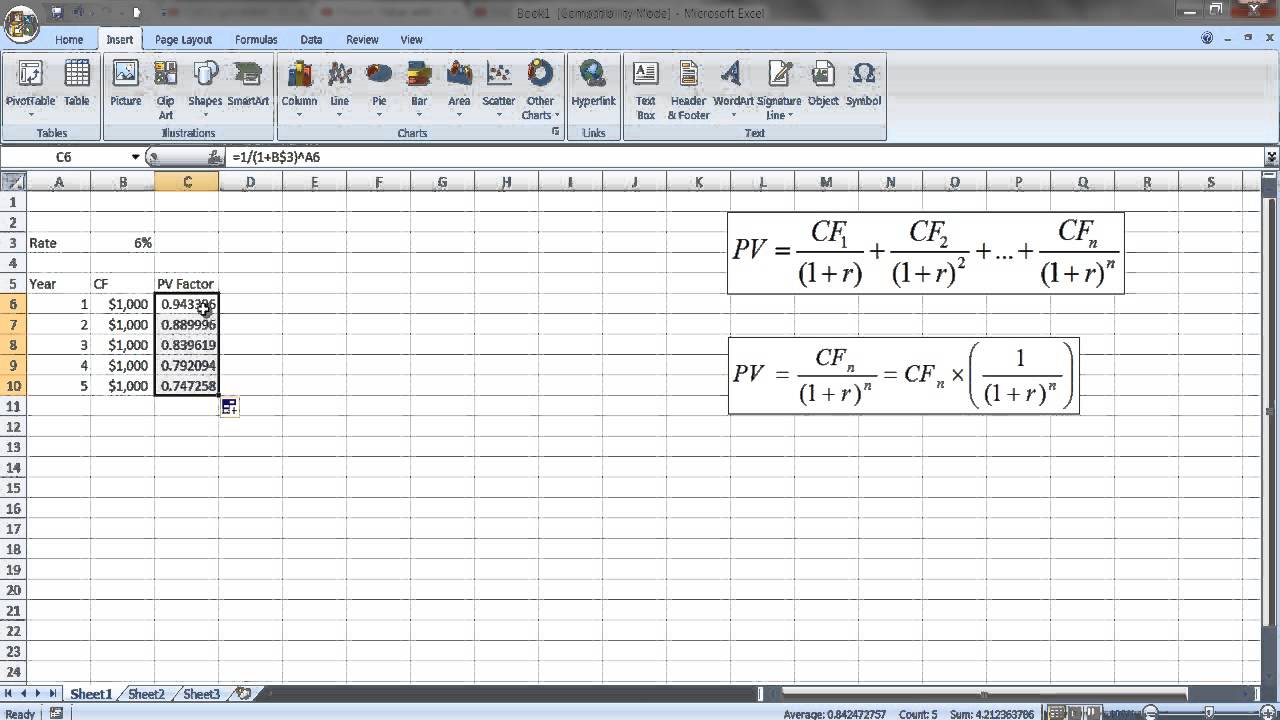

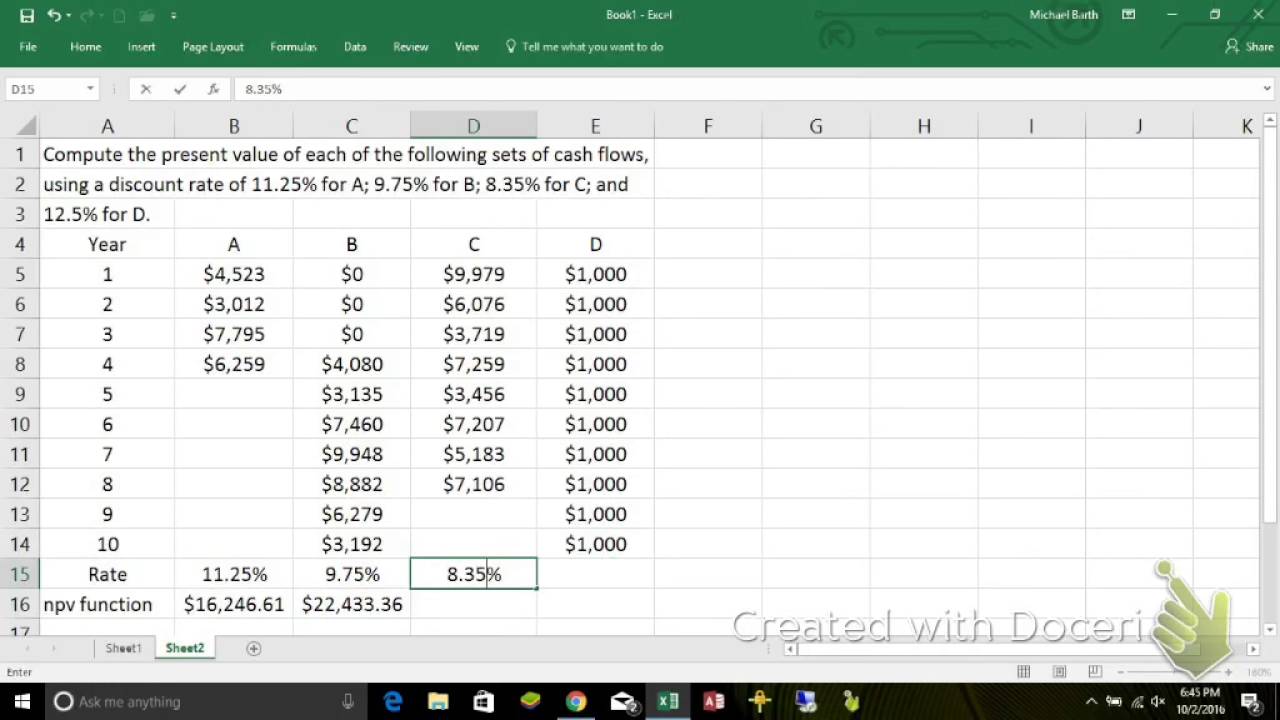

. NPV is used in capital. One can proceed to estimate the present values of all future cash flows by using the NPV formula. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money.

Here the example picture of calculator field. PV formula examples for a single lump sum and a series of regular payments. Present worth is defined as the value of a future sum of money or cash flow stream at present given a rate of return over a specified number of periods.

Type 12 Enter and then press down arrow and you will see NPV 000. Dividends Per Share DPS. Gordon calculates the fair value of a stock by examining the relationship between three variables.

Given a situation where you have to decide whether to receive or pay any amount of sum today or in future assessing present value of future cash flows helps in taking effective decisions by comparing todays cash flow with a. Our online Net Present Value calculator is a versatile tool that helps you. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time.

These cash flows are then discounted using a discount rate termed cost of capital to arrive at the present value of investment. Calculate the Net Present Value NPV of an investment. Cost of Equity Discount Rate.

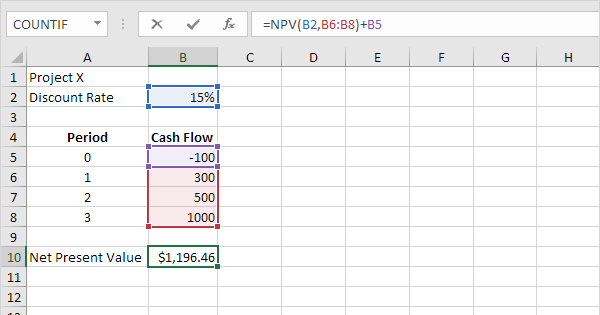

Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. The tutorial explains what the present value of annuity is and how to create a present value calculator in Excel. In other words NPV is simply value minus cost.

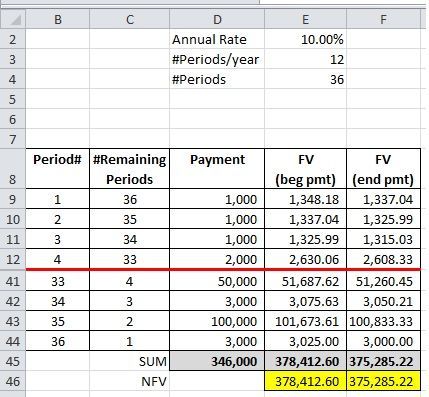

Lets assume we have a series of equal present values that we will call payments PMT and are paid once each period for n periods at a constant interest rate iThe future value calculator will calculate FV of the series of payments 1 through n using formula. Discounted cash flows allows you to value your holdings today based on cash flows to be generated over the future period. Each future cash flow is discounted back to the present time at a 12 discount rate.

2nd FV then enter -100017922 into the PV key. The concept of present value is useful in making a decision by assessing the present value of future cash flow. Net Present Worth Calculator - Investment with Fixed Cash Flow and Growth Rate.

Step 6 To arrive at the present value of the perpetuity divide the cash flows with the resulting value determined in step 5. It is the amount of money which will grow over a period of time with simple or compounded interest. The net present value is simply the difference between the present value of all cash flows inflows and the present value of all cash outflows.

The Gordon Growth Model GGM named after economist Myron J. To get the present value of the cash flows press CPT. In this step we should discount the projected free cash flows and the terminal value to their present values called the Net Present Value NPV of future cash flows by using the discount factor.

The Basis Of Comparison Between Present Value vs Future Value. Involved both discounted as well as the interest rates. This will allow you to scroll through.

Popular Course in this category. Present value of lease payments explained. We also provide a Present Value Calculator with a downloadable excel template.

To begin organize your cash flows into a table beginning with the cash flow at t0 going through to t3. The present value of annuity can be defined as the current value of a series of future cash flows given a specific discount rate or rate of return. Thus this present value of an annuity calculator calculates todays value of a future cash flow.

Similar to unlevered free cash flows FCFs the WACC represents the cost of capital to all capital providers eg. As it has total 7 number of cash flows including initial investment. Example 31 Future Value of Uneven Cash Flows.

Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Assuming that the business valuation discount rate is at 12 computation for discount factors for years 1-5 are as follows. Calculate the present value of all the future cash flows starting from the end of the current year.

Involved only interest. It is the current value of future cash flow or future value. You may also look at the following articles to.

Step 4 Next determine the growth rate if any corresponding to the infinite cash flows. If youre building an unlevered discounted cash flow DCF model the weighted average cost of capital WACC is the appropriate cost of capital to use when discounting the unlevered free cash flows. The present value aka.

The PV will always be less than the future value that is the sum of the cash flows except in the rare case when interest rates are negative. Investment money out - at period 0 Fixed Cash Flow money in - or saved - from period 1. Future cash flows are discounted at the discount.

Then each of these present values are added up and netted against. Excel has a built-in function for net present value. Net Present Value - NPV.

The reason behind discounting the cash flows is that the value of 1 to be earned in the. Future Value Annuity Formula Derivation. DPS is the value of each declared dividend issued to shareholders for each common share outstanding and represents how much money.

N is 5 and IY. Present Value - PV. The concept reflects the time value of money which is the fact that receiving a given sum today is worth more than receiving the same amount in some future date.

Then just subtract the initial investment from the sum of these PVs to get the present value of the given future. So use the Add button to add extra cash flow field. Gordon Growth Model Overview.

Remember that the cash flow at t0 is an investment and is a negative outflow. The annuity may be either an ordinary annuity or an annuity due see below. To get the value of IRR simply click calculate button which will take you to the next page showing the result.

At any time you can return to cash flow mode by pressing CF. Present Value Formula and Calculator The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. Step 5 Next determine the difference between the discount rate and the growth rate.

The calculator below can be used to calculate the Net Present Worth for a project with a fixed investment value and fixed return cash flows with a growth rate. Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments to.

Future Value Of Cash Flows Function Microsoft Tech Community

Calculate Npv In Excel Net Present Value Formula

Present Value Of Cash Flows Calculator

Using Pv Function In Excel To Calculate Present Value

How Does The Net Present Value Of Future Cash Flows Work In Excel Excelchat

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Present Value Multiple Cash Flows In Excel Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

Calculating Npv In Excel With Negative Cash Flows Excelchat

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Excel S Npv Function For Pv Of Uneven Cash Flows Youtube

How To Use The Excel Npv Function Exceljet

Computing The Present Value Of Future Cash Flows Using The Excel Pv Function Youtube

Npv Formula In Excel In Easy Steps

The Difference Between Annual Vs Monthly Npv In Excel Excelchat